COMMERCIAL DUE DILIGENCE

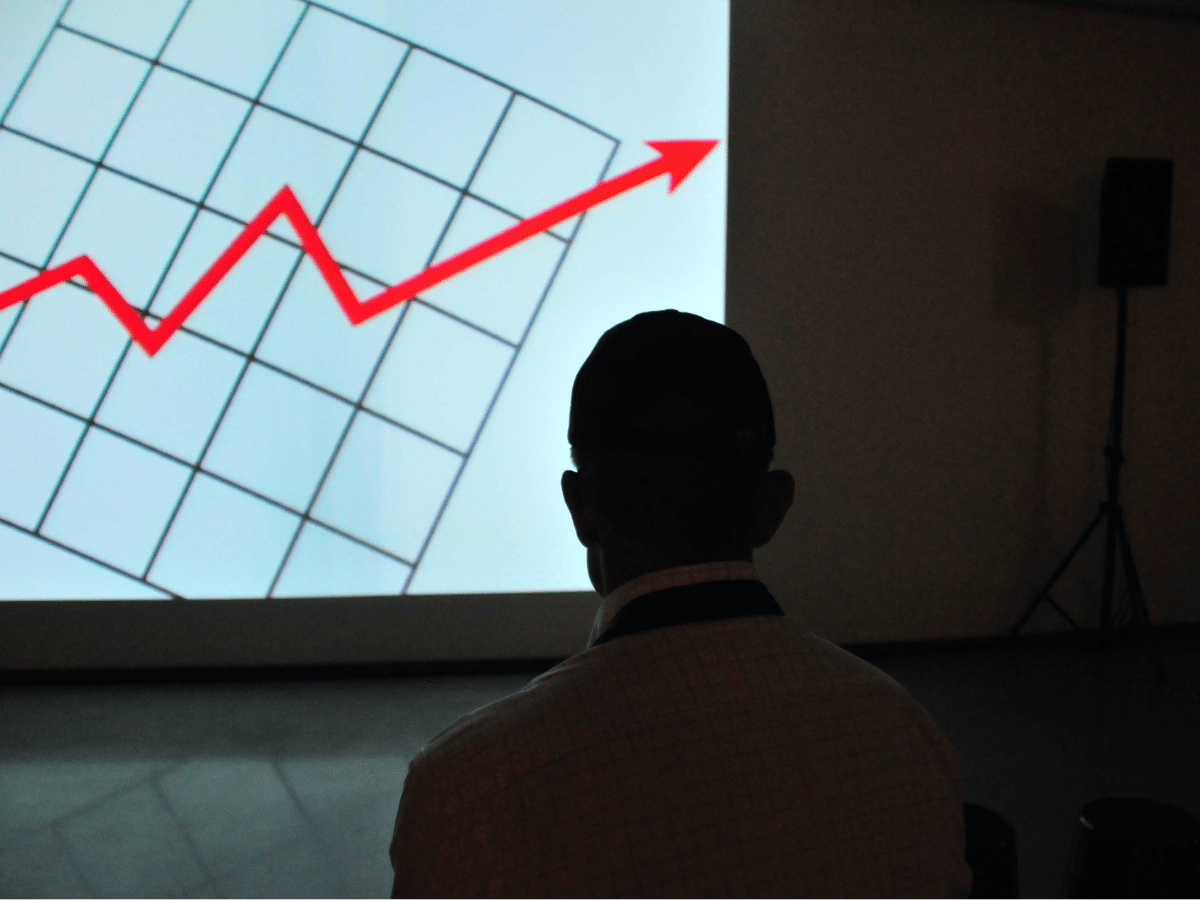

When it is time to secure refinancing or prepare for an M&A for your terminal, due diligence and risk assessment studies are key.

Commercial Due Diligence

Banks, financial institutions, and other investors will only consider a refinancing or M&A proposal to be bankable when it is realistic, as well as convincing and compelling, too. You need an independent partner with in-depth knowledge of the tank terminal industry to help give your proposal that extra edge.

That partner is us: Insights Global. Our proven track record of nearly 50 years in collecting and providing data on the tank terminal industry means no other consultancy firm can offer market information specific to the tank terminal sector like we can. Just like you, we know the market on the ground both locally and globally. We deliver bankable Commercial Due Diligence reports by using a proven methodology and our own forecasting modeling tool.

Tank terminals are considered infrastructure assets with a low-risk profile that generates stable revenue streams. An appealing investment for banks, financial institutions, and shareholders.

But in this fragmented market, competition is fierce. Under normal market circumstances, there are several operational, economic, and infrastructural variables involved in the successful operation of a tank terminal. And now, the industry seems to be in a fluid state with many known and unknown challenges looming ahead. With all these challenges, how can you secure financing for an M&A or refinancing to ensure the future of your terminal?

Deliverables

Thanks to our experience in creating due diligence reports for the terminal industry, you will receive:

- An overview on how location, infrastructure, and connectivity impact your tank terminal’s operations and competitiveness.

- An overview of the competitive landscape through benchmarking and SWOT analyses.

- A future outlook of logistics, supply, demand, imbalances, trade flows, and storage rates.

- An overview of the downward risks, upward potential and mitigating actions.

- A bankable report.

Benefits

Clear scope of the market

You have a clear understanding of the target’s competitiveness, the market size and outlook, a business plan, and the risks and upward potential.

Solid answers for your investors

You are able to make the most convincing and compelling case possible. You can answer any questions or further inquiries investors may have quickly and convincingly.

Critical market intelligence

Crucial facts can be key to securing financing. Facts like large numbers of tanks, varied tank range, and a competitive berth to capacity ratio. We have this information updated every day on our databases at TankTerminals.com, so for us, this information is always accurate and within immediate reach.

Access to unsurpassed knowledge and experience

No other consultancy firm can beat our level of knowledge and experience on supply chains in the international petroleum and petrochemical industries. Like you, we understand the dynamics, the drivers, and the trade flows in this specific domain of the oil and chemical value chain.

DOWNLOAD OUR WHITEPAPER

For more information on how a Commercial Strategy from Insights Global can help you, download our Commercial Assessment whitepaper.

Schedule a call with Insights Global

Need a sparring partner to get to grips with the ever-changing Tank Terminal industry?