Speculators are often drawn to organisations that have a track record of failure and no revenue or profit because of the thrill of investing in a business that has the potential to turn a profit.

However, the truth is that investors will typically collect their loss share when a company has annual losses over an extended period of time. A business operating at a loss has not yet demonstrated its worth through profits, and soon outside funding may stop coming in.

Even in this day of tech-stock blue-sky investing, a lot of investors stick to a more conventional approach, purchasing stock in successful businesses like Aegis Logistics. Now, this is not to argue that the business offers the greatest investment opportunity available, but business success largely depends on profitability.

From a COVID low of 2020, the company has given a return of 190 percent. But the stock has been volatile for the past one year just giving a return of 20 percent. So, should you take the opportunity of this consolidation to invest for the long term? Well, for that let’s understand the business of Aegis Logistics and what the future holds.

Corporate Overview Of Aegis Logistics

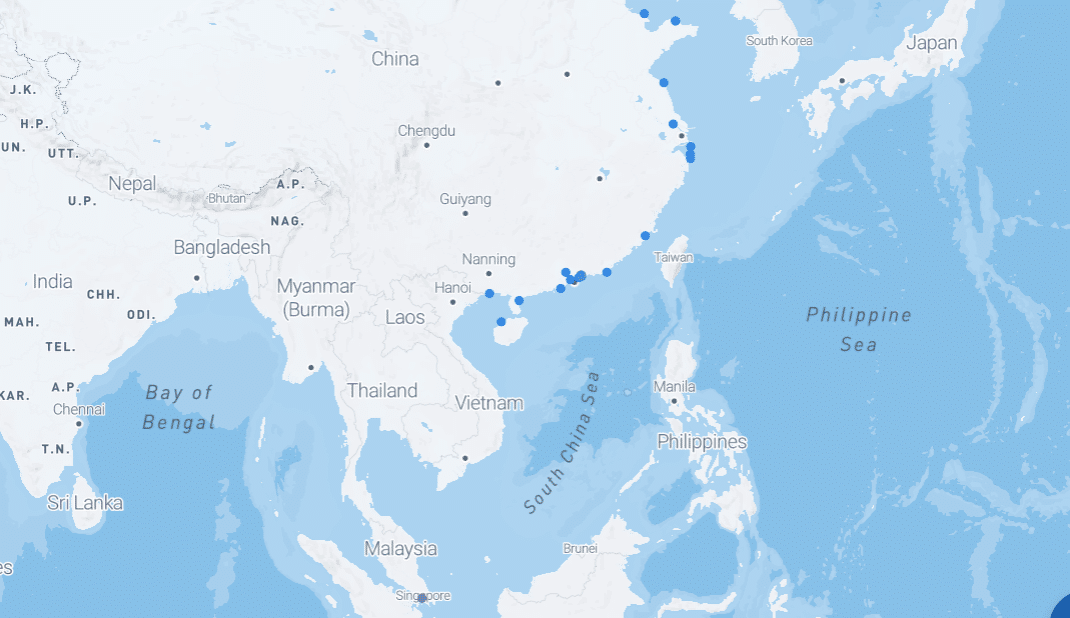

Aegis Logistics is the top private player in India for LPG imports and handling, and it leads the country in integrated oil, gas, and chemical logistics. The company uses its cutting-edge Necklace of Liquid & Gas terminals, which are located in India’s main ports and have a static capacity of 1,14,000 MT for LPG and 15,70,000 KL for Chemicals & POL storage.

With its headquarters located in Mumbai, Aegis Group was established in 1956. Aegis Logistics is a well-known Liquefied Petroleum Gas (LPG) parallel marketer with a strong presence in India.

The company has a sizable network of distributors that offer LPG cylinders and appliances to residential, commercial, and industrial clients. It also has a large distribution of retail outlets that dispense autogas.

To help major enterprises switch from alternative fuels to LPG and optimize their economic benefits, Aegis also offers LPG installation and interfuel services.

Business Segments Of Aegis Logistics

The company has two primary business segments – the Liquid Logistics Division and the Gas Division.

Liquid Logistics Division

Revenues from liquid terminalling increased by approximately 54.80% to ₹417.97 crore from ₹270.01 crore in the prior year. The division’s EBITDA also increased, reaching ₹271.50 crore from ₹195.59 crore. This segment contributed the highest percentage to the overall revenue.

The product mix and the capacity increase at Mangalore, Kandla, and Haldia increased EBITDA performance by 38.81%. Future capacity increases at Haldia, Kandla, Mangalore, and Kochi, along with increased capacity utilization and a better mix of products handled at those ports, will drive growth in this segment. The Mumbai terminals are still operating at maximum capacity.

Gas Division

Aegis Group encompasses the entire logistical value chain, from LPG distribution to sourcing and terminalling. Due to increased volumes and prices, the division’s revenues in FY 2022–2023 were ₹8,209.25 crore as opposed to ₹4,360.97 crore in the prior year.

The Gas division’s EBITDA climbed to ₹526.23 crore from ₹389.32 crore the year before, mostly as a result of increasing terminalling and distribution volumes. This segment contributed almost 95 percent to the overall revenue.

For FY 2022–2023, distribution of LPG and propane across all channels in bulk and packaged cylinders remained a priority. The integrated logistical services offered by Aegis Group position the company to win market share and realize the aim of a more sustainable future, while the continuous development indicates an increasing demand for LPG.

Financials Of Aegis Logistics

In the fiscal year 2023, Aegis Logistics saw a substantial increase in revenue, surging by 86.3% to reach ₹8,627.21 crore as opposed to ₹4,630.98 crore in FY2022. Analyzing a span of four years, encompassing FY2020 to FY2023, the company displayed a Compound Annual Growth Rate (CAGR) of 6.3% in revenue.

Simultaneously, there was a noteworthy upturn in net profit, experiencing a 33% increase from ₹384.94 crore in FY2022 to ₹510.7 crore in FY2023. Over the cumulative four-year period from FY2020 to FY2023, the net profit showcased 56.21% CAGR.

In FY23, Aegis Logistics maintained favorable financial metrics with a Return on Equity (ROE) of 17.88% and a Return on Capital Employed (ROCE) of 17.08%.

Future Plans Of Aegis Logistics

Better Economics With LPG

According to the Kelkar Committee report, the industrial sectors primarily rely on imported LNG, which costs INR 45.6 per scm, while domestically produced natural gas is primarily utilized for PNG in households and CNG in automobiles. Compared to propane LPG, which costs INR 42.2 per square meter, this is more expensive.

Furthermore, the heat content of natural gas is 10,000 Kcal/scm while that of propane is 12,467 Kcal/scm. Propane uses less energy density and has a higher calorific value to generate the same amount of heat. Therefore, propane is less expensive than natural gas at INR 3.38 per million calories compared to INR 4.56 per million calories for natural gas.

To get LPG gas at a lower cost, Aegis Logistics has a joint venture (JV) with Itochu Corporation, a Japanese multinational corporation. This allows AEGIS to offer more competitive propane LPG rates in the industrial gas market.

New Storage for Green Ammonia

Aegis Logistics and Royal Vopak NV, a Dutch multinational company that specializes in the storage and management of a range of products, including chemicals, oil, gases, biofuels, and vegetable oils, have formed a 51:49 joint venture known as Aegis Vopak Terminals Ltd (AVTL).

Across five important Indian ports on the east and west coastlines, this joint venture oversees 11 terminals. With a total capacity of over 960,000 cubic meters, AVTL is becoming a significant participant in the independent LPG and chemical tank storage market in India.

The company’s next phase of growth would involve investing INR 1,000 crore to build a plant in Odisha that can store 80,000 tonnes of green ammonia.

Robust Expansion Plans

The company has several upcoming port construction projects that will boost the capacity of the Liquids division in the future. The Kandla Port which has a capacity of 35,000 KL is expected to commission in Q4FY24.

The company expects the JNPT Port which has an 110,000 KL capacity to be commissioned in phases and will be fully operational by June 2024. The Mangalore Port which has a 76,000 KL capacity is also expected to be partially operational by the end of FY24 and the balance in Q1FY25.

Conclusion

After understanding Aegis Logistics’ financials, growth drivers, and future expansion plans, it seems the company is well-positioned for long-term growth. With strong profitability, increasing capacity, and focus on the high-potential LPG market, Aegis could continue its upward trajectory.

However, with some recent volatility, investors should assess if the current valuation prices are too much for future optimism. What do you think – is Aegis’ growth story still intact and is now the time to buy in?

By: Tank Terminals / Trade Brains , April 09, 2024