What You Should Know about IMO2020 (Part 2)

Click here to read part 1.

A Change for the ARA bunker markets

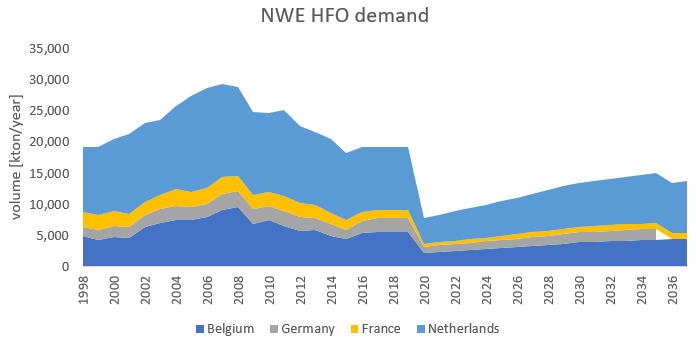

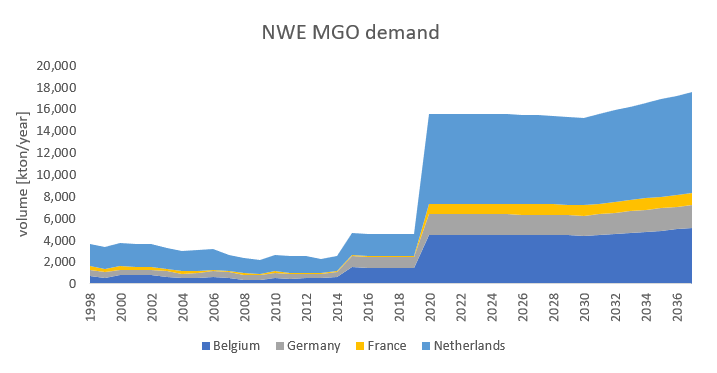

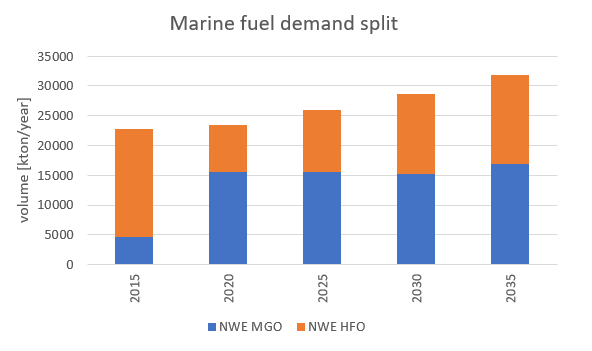

Insights Global structurally forecasts the future supply and demand of oil products in the ARA region and naturally incorporates IMO 2020 into its models. In our forecasting models we predict an annual growth rate for marine fuels that is adjusted for efficiency gains of ships, while the split between HSFO and MGO in bunker demand switches in 2020 and is submissive to price changes and upcoming alternative fuels. We predict a sharp decline in heavy fuel oil demand with simultaneously a jump in the demand for (marine) gasoil in 2020. The heavy fuel oil demand is expected to more than half in size, whereas MGO demand is predicted to quadruple. Our assumption for the post-2020 era is that the shipping industry will gradually switch back to fuel oil using scrubbers or 0.5% LSFO. Furthermore, LNG will take in a more dominant position, up to 11% in 2030. This will diminish the share of gasoil used and lead to a slight decline in gasoil demand between 2020 and 2030.

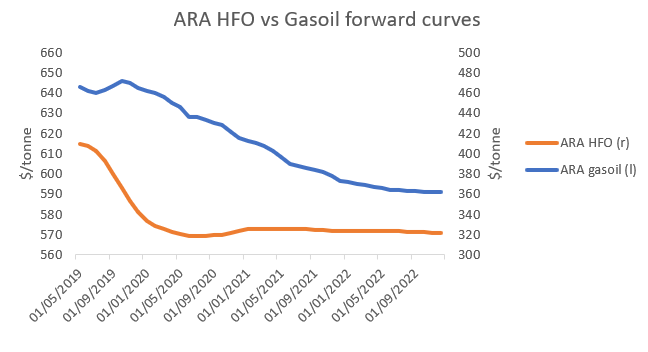

The transition from high sulphur fuel oil to marine gasoil and the changing demands for both products can be seen in the futures markets. The forward curve for HFO makes a steep dive towards the beginning of 2020 when the regulation comes into force. The gasoil prices show an inverted pattern: a small contango until the start of 2020 can be seen as demand for the product will be the largest when the legislation becomes active. After these initial price extremities of gasoil and HFO the markets settle down as HFO prices recover slightly while gasoil prices enter a backwardated situation. This is in line with our demand forecasts and resembles the extent to which alternatives such as scrubbers gain an increasingly larger share. We expect subsequent waves of investments in shipping but also in refining, as the production of 0.5% fuel oil becomes more profitable. For more complex refineries with a certain crude slate this will offer opportunities while for other, more simply configured refineries, their continuity is at stake.

A Change for the Tank Storage Business

The ARA region currently is a net-importer of gasoil and is the final destination for many of the world’s gasoil flows. Estimates are that in 2022 the deficit would increase by between +12% and +34% relative to 2018 values, primarily driven by IMO 2020. The changing imbalances of gasoil and fuel oil in the ARA region will have an impact on the ARA tank storage business. The lower fuel oil demand will increase the oversupply of fuel oil in the region and as such affect all tank terminals who lend their facility to this product. The changing environment for fuel oil tank storage will eventually lead to higher fuel oil storage rates in the region. Fuel oil storage rates are likely to remain depressed in 2019, but when the IMO regulation hits the markets in 2020 the oversupply of fuel oil is likely to switch the markets into a contango, supporting the storage business. This effect is expected to be reinforced when the crude markets switch to contango as well.

Higher storage rates for fuel oil are thus expected, but the current fuel oil tank storage business nevertheless faces a tough time from a logistical point of view. Terminals in ARA specialized in fuel oil are either busy in the bunkering market or in the transit business. In the first case these terminals will suffer from the reduced size of the HFO bunker market. In the second case the business is more related to the flow from Russia towards Far-East. This transit flow is also expected to be marginalized in the medium term and long term. Therefore tank terminal operators storing HFO will need to anticipate on these changes and explore options in order to cope with possible oversupply of fuel oil tanks. Less tanks for fuel oil storage will be needed, but opportunities lie in diversification. From 2020 onwards more grades of bunker fuel (a.o. ULSFO, 0.5% LSFO, 3.5% HSFO) will need to be stored, while smaller tanks as well as blending capabilities will become more important.

Running up to the bunker fuel spec change in 2020 the fundamentals for the gasoil storage market are likely to improve following more interest in middle distillate tanks and the need for more grades of gasoil. The contango that is developing in the gasoil markets supports the storage rates as well. In 2020 however we expect a halt to the growth of gasoil storage rates caused by a backwardated market structure following the higher spot prices. After 2020 we expect storage rates to improve with the gasoil markets following the contango formation in the crude markets, albeit to a smaller extent. More tanks are needed in this bunker market to store middle distillates which could increase competition, but occupancy rates in the medium term will remain high due to increased demand.