Tank Terminals are filling up with oil: who is profiting and how long until tanks are full?

The world is in crisis mode. The Corona virus is gripping humanity, leading to lockdowns, overcrowded hospitals and thousands of casualties. Oil markets are also heavily impacted. As a direct of effect of the Corona lock downs global oil demand plummeted. The OPEC+ cooperation also exploded. Russia and Saudi Arabia couldn’t agree on output cuts. As a result an outright fight for market shares erupted between both heavyweights with oil prices collapsing as a consequence.

Oil markets are totally out of balance. The demand destruction due to the many lockdowns around the world combined with the production increases coming from Arab Gulf States is leaving global markets oversupplied. Estimates range from 10mb/d to 20mb/d. Quite a big range, so no-one really knows how much. But one thing is certain: it’s a very big number. And there is no end in sight. Petroleum markets are notoriously slow in balancing out. Supply is slow to react to low oil prices as costs of maintaining production levels are low. The unit costs associated with crude oil production are mostly costs associated with exploration, drilling and completing wells. After this is finished these are sunk costs, so not relevant anymore. As a result producers will keep pumping oil until prices hit rock bottom.

Due to the oversupply situation a contango emerged on futures markets. In a contango situation prompt oil prices are lower than forward oil prices. Traders are stimulated to buy crude or oil products on the spot market, in order to increase demand, and put this oversupply into storage so that they can sell it on the futures market for higher prices and for delivery somewhere in the future. The contango is there to enable traders to earn money on this play. Otherwise they would not be encouraged to buy crude and oil product from producers because there is no demand. This is called storage arbitrage and this is perfectly in line with what the markets need: filling up tanks to store the oversupply and decreasing oil prices to limit production rates and stimulate consumption.

Who is profiting?

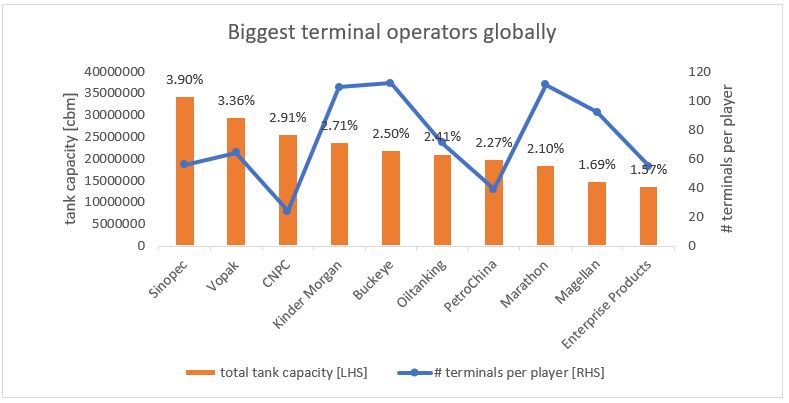

The contango has prompted a run on tanks. If you are able to find free tank capacity now you can make a fortune. Tank terminal owners are, despite the current depressed economic situation, in the best position that they can imagine. But who are these ‘winners’? See below a graph showing the global top tank owners.

Graph 1: global tank storage players

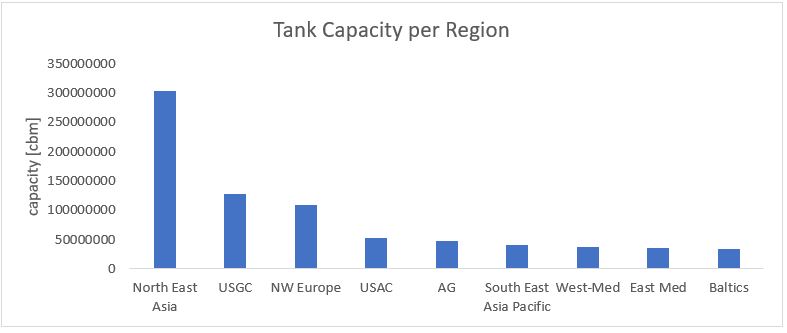

Also globally tank capacity is distributed unevenly and mostly concentrated in hubs. See below for tank capacity per region. As you can see North East Asia, with China included, the country where the outbreak started, has the most tank capacity. The USA and Europe are second and third in this ranking order.

Graph 2: tank capacity per region

How long until tanks reach tops?

For oil markets it is of vital importance to have spare tank capacity to absorb imbalances. However, the current oversupply is immense. How long will it take until global tank storage capacity is full?

Let’s assume that current oversupply is on average around 10mb/d for the coming months. It is probably higher right now but may decrease after the situation becomes normal again and the various lock downs and measures to contain the virus are lifted. Looking at current stock levels in the main hubs, ARA, USGC, Fujairah and Singapore, we see that approximately 75% of commercial tank capacity is full.

That leaves only 25% to go until tank capacity has reached tops. If we assume that this 25% applies to all independent tank capacity globally we can calculate, using global crude and petroleum products tank capacity and correcting for strategic petroleum reserves that are assumed to have a much higher utilization rate, that it will take about 112 days or almost four months for tanks to reach their full capacity.

After tank terminals are full the next most economic option is to charter vessels and use these vessels as floating storage. According to various sources we are already seeing this happen in shipping markets. So in reality, because the combined storage capacity is simultaneously being filled up, it might take a little bit longer for tanks to fill up.

In any case our ARA oil products stock data, Rhine flow data will give a good view on developments in European storage. If you require data to understand global tank terminal capacity our TankTerminals.com database is a vital piece of information you can use, either for analysis or to find free tank capacity. Let us know if you need anything!

Kind regards,

Photo by Clyde Thomas on Unsplash