European refining margins lagging, more closures expected?

As of April 2025, Europe’s refining industry is navigating a landscape of further diminishing margins, influenced by a combination of economic pressures, policy shifts, and global competition. This downturn is prompting significant strategic adjustments within the sector, which is already coping with various closures seen in the past months and more to come for 2025 and beyond.

Current State of European Refining Margins

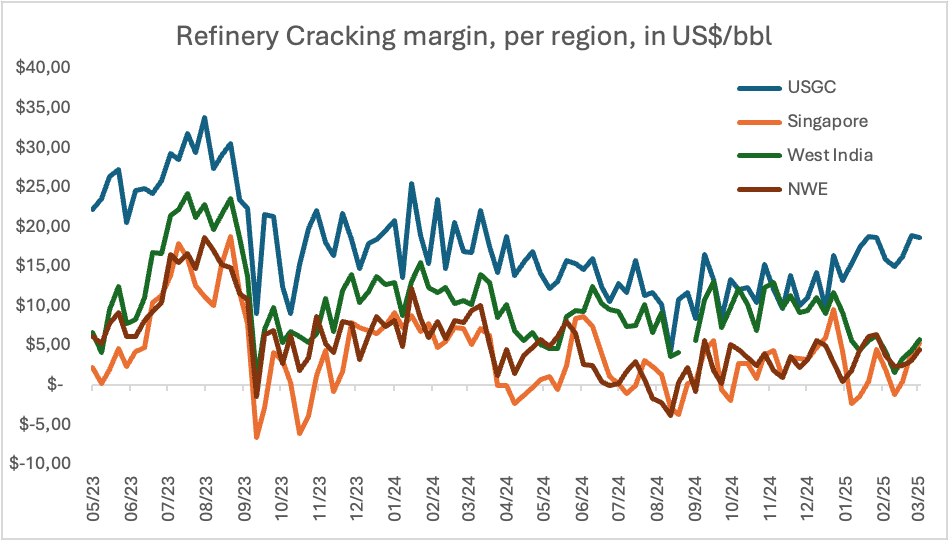

In 2024, European refining margins experienced a notable decline. Northwest Europe’s ultra-low sulphur diesel margins, for instance, decreased from $42 per barrel in 2022 to $29.71 per barrel in 2023. Its cracking margins remained on low levels during 2023 and 2024 which means the region could no longer remain competitive compared to other key regions. This downward trend is also attributed to factors such as reduced local European demand due to the energy transition and electrification, increasing competition from new refineries worldwide, and elevated operating costs stemming from stricter emissions regulations.

Potential Consequences

The sustained pressure on margins is leading to significant restructuring. For example, ExxonMobil announced plans to downsize operations at its Port-Jerome complex in France while BP is scaling back its Gelsenkirchen refinery in Germany by a third (and open for interested buyers to acquire the facility). Ineos will shut down its Grangemouth refining this spring and Shell has turned off the crude distillation units at its Rheinland Wesseling site in March, which could drop total refining capacity in the Northwest European region by 650.000 bpd. This could weaken the European competitiveness of the region and increases its reliance on imports from other regions, increasing vulnerability to and volatility of prices, product availability and importance of the supply chain.

The introduction of tariffs and changing trade policies are reshaping global oil flows. European refiners may find opportunities in markets previously dominated by U.S. exports, but also face heightened competition from new refineries in regions like West Africa (Nigeria, Angola) and Latin America (Mexico, Argentina). This is already leading to a downturn in gasoline export out of key hubs in ARA and a steady flow of (more cost-effective) jet fuel from Nigeria’s Dangote refinery to the US Gulf Coast.

European refiners are increasingly investing in renewable energy projects to align with the energy transition. However, falling profits are testing the viability of these green initiatives, with various projects facing delays or cancellations due to economic constraints. The latest examples include postponing SAF production by BP in its Spanish refinery and various (green) hydrogen initiatives in the region.

In conclusion, Europe’s refining sector is at a pivotal juncture, contending with declining margins and the obligation to adapt to a rapidly evolving global energy landscape. Strategic decisions made now will be crucial in determining the future resilience and competitiveness of the industry.

Barge volumes, prices, & disruption: navigating the impact of NW Europe refinery closures

Refinery closures in North-West Europe are triggering significant shifts across the liquid bulk supply chain. With capacity reductions and structural changes taking place, market participants are facing growing uncertainty in product availability, trade flows, and barge utilization.