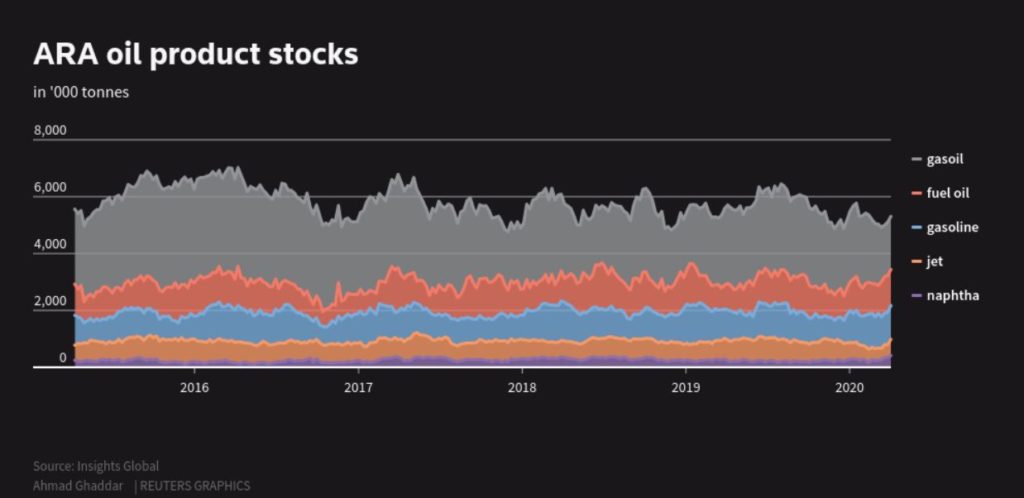

June 18, 2020 — Total oil products held in independent storage in the Amsterdam-Rotterdam-Antwerp (ARA) trading hub fell on the week after reaching their highest since at least 2003 a week earlier, according to consultancy Insights Global.

Stocks reached fresh record highs in each of the three previous weeks, supported by contango in the forward curves of the underlying crude futures and Ice gasoil contracts owing to the massive reduction in demand caused by the Covid-19 pandemic and related lockdowns. But stocks fell during the week to yesterday, amid rising demand for oil products within northwest Europe and in export regions.

Gasoline inventories fell. The amount of cargo movements, both on barges and on seagoing tankers, eased after an exceptionally frenetic week across the ARA area a week earlier. Exports to the US remained broadly stable on the week at a high level, but no tankers departed for China. Tankers also departed for Canada, the Mediterranean, Singapore and west Africa. Cargoes arrived from Finland, France and Russia. Congestion in the regional barge market eased, particularly around Amsterdam.

Fuel oil stocks fell heavily in the week to yesterday. Flows of high-sulphur fuel oil to the Middle East for power generation continued, with two Aframax tankers departing for Saudi Arabia during the reporting period. Tankers also departed for the Mediterranean. No fresh fixtures emerged on the arbitrage route to Singapore, and cargoes arrived in the ARA from the UK and Russia.

ARA gasoil stocks rose on the week, reaching fresh ten-month highs. At least one tanker carrying gasoil discharged in the ARA after having waited in the North Sea since 8 May. Steep contango across the product markets prompted the booking of tankers to store volume offshore, but total volumes are easing as end-user demand rises. High inventories in Germany weighed on barge flows from the ARA to destinations up the river Rhine, supporting stock levels downriver. Tankers departed for France and the UK, and arrived from Russia, Saudi Arabia and Singapore.

Jet kerosine inventories fell, and as with gasoil at least one tanker discharged following a period of use as floating storage. Tankers departed for the UK, and local demand rose as European civil aviation begins to restart following the outbreak of the Covid-19 pandemic.

Naphtha inventories fell. No tankers departed the area, but local demand for the product from gasoline blenders was firm during the reporting period, and several petrochemical end-users bought cargoes. Tankers arrived from Latvia, Russia and the UK.

Reporter: Thomas Warner