Themes that impact ARA Oil Tank Terminal Market

The tank terminal market in ARA is facing several challenges and issues that influence the short- and mid-term dynamics. Oil market developments, globally and regionally, could have an impact on the ARA Oil tank terminal market.

We have selected three main themes that impact ARA oil Tank Terminal markets in the short and medium term:

COVID-19 outbreak: Increase in tank demand and storage fees due to massive oversupply on petroleum markets (deep contango)

IMO 2020 and changed bunker fuel specifications: Growing ARA tank storage demand

Electrification of passenger cars: Downward effect on road fuels consumption but mixed effects on tank storage demand

Reverse dieselization of European passenger car sales: The change in car sales might decrease structural imbalances and lead to less demand for tank capacity

COVID-19 outbreak

Since the beginning of the Corona crisis the market is clearly in contango. Looking to the calendar spread it was already expected that market would move into contango on a short term. However, the Corona crisis was the big trigger for the start of the contango period. As the graph shows the market is in a deep contango and how long this situation will persist is the main question. It depends on how fast the production and demand of oil products will become in balance again.

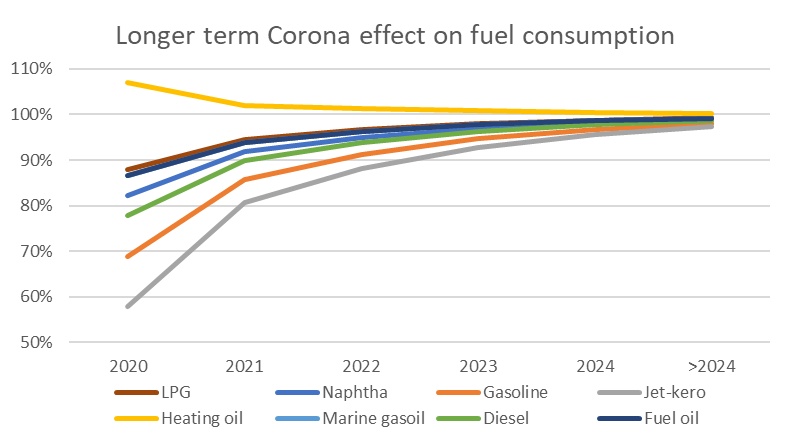

As we all experience the impact of Covid-19 is huge on our daily life and therefore also on our fuel consumption. The Corona effect needs to be incorporated on the forecasting models. Assumption is that the current lockdown lasts three months and has a negative impact for all fuels with the exception of heating oil. Reduction of diesel and LPG volumes are a bit lower because both diesel and LPG consumption is not limited to passengers’ vehicles. Commercial vehicles like buses and trucks don’t use gasoline fuels but usually diesel or LPG. Jet-kerosene is very much hit as almost all passenger traffic has stopped.

Reduction lockdown

LPG: 27%

Naphtha: 40%

Gasoline: 70%

Jet-kero: 95%

Heating oil: -20%

Marine gasoil: 30%

Diesel: 50%

Fuel oil: 30%

Reduction after lockdown in 2020

9%

13%

23%

32%

-3%

10%

17%

10%

After the lockdown, consumption level will gradually normalise, which will take five years. However, it is unclear yet what the exact impact of Covid-19 will be on the travel behaviour of people.

IMO 2020

The International Maritime Organization (IMO) has implemented its global legislation to limit sulphur emissions as a result of marine fuels. The legislation calls for a reduction of the sulphur content in marine fuels to less than 0.5%, which has started January 1st, 2020. Until the start of 2020 the limit was 3.5%. The first months of 2020 show that VLSFO seems to be the dominating bunker fuel. Consumption of MGO increased only slightly by around +10%. HFO is about 15-20% of total fuel oil consumption, with the rest being mostly VLSFO.

The consumption of bunker fuel is heavily correlated with global trade, so we expect it will take several years before bunker fuel market is at the same level as in 2019. However, terminals in ARA specialized in fuel oil will benefit from the growing size of the fuel oil bunker market. As the number of grades has increased and more components are needed to blend into the 0.5%FO / HSFO / MGO, more storage capacity is needed.

Additionally, on top of these structural effects on fuel oil supply, demand and imbalances, there is an enormous oversupply in the market due to the COVID-19 / Corona crisis. This has resulted in a steep contango in fuel oil forward prices and is stimulating traders to buy and store excess fuel oil supply. This provides major support for fuel oil storage rates in the short to medium term.

Electrification of passengers’ cars

Electric mobility is growing very fast. In 2018, the global electric car fleet exceeded 5.1 million, up 2 million from the previous year. China sold over 1 million cars in 2018, followed by Europe (385,000) and US (361,000). Norway has the highest market share for sales (46% in 2018). According to the IEA the projected growth in the New Policies Scenario of electric vehicles would cut oil products by 2.5 million barrels/day.

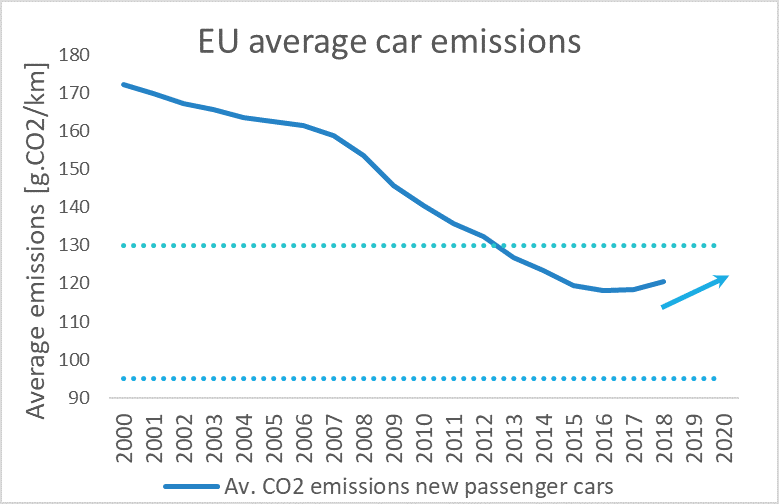

In a push to limit GHG emissions originating from vehicles the European Commission has imposed emission targets to car-producers. New cars are tested and need to have CO2 emissions lower than a certain limit. This limit has been gradually lowered to an average of 130 gram per kilometre in 2015 and will be lowered even further to 95 gram per kilometre as from 2021. CO2 emissions are directly proportional linked to fuel efficiency and therefore have a direct effect on consumption volumes per car per kilometre. As from 2025 the EU emission target is -15% relative to 2021. As from 2030 the target is set on -37.5% relative to 2021.

If car manufacturers do not comply to these targets, they will get penalties because of non-compliance. As BEV’s count as zero emissions cars, it is expected that these targets drive the production of electric cars.

However, reality is different as EU average car emissions are increasing again, see figure 5.6b. Higher SUV sales and not diesel decline have resulted in higher CO2 emissions.

Nevertheless, this electrification trend will have an impact on the gasoline consumption. In ARA the port of Amsterdam plays a central role in the gasoline segment. Because Europe has a structural surplus of gasoline there is a continuous flow being exported out of Europe to gasoline outlets. Consumption of European gasoline is expected to decrease, mainly because the electrification of its car fleet. As the production of gasoline will not decline or not decline that fast, it is expected that the surplus of gasoline will increase, which is beneficial for terminal operators.

Reverse dieselization of European passenger car sales

Due to a mix of governmental policies and changes in consumer preferences the share of diesel-powered cars relative to total cars sales has shifted dramatically in Northwest Europe. Consequently, the consumption of diesel is decreasing and it is expected this trend will continue. As production of diesel will not decline or not decline that fast, the deficit of gasoil / diesel is expected to decrease, which is not beneficial for terminal operators.

Conclusion

Although the oil market is really hit by Covid-19, the direct impact on oil terminal operators is positive as the market is currently in a deep contango. Consequently, tanks are rented out and storage fees have increased significantly.

Other themes like IMO 2020 and electrification of passenger cars seem to have positive effects on the profitability of terminal operators. IMO 2020 create more tank storage demand because of a higher number of bunker fuel grades and more components that are needed, while for gasoline the structural imbalance is expected to increase.

However, for the storage demand for diesel is expected to decrease because the current deficit is expected to decrease.

Having access to accurate, up-to-date oil storage rates is crucial to make the right business decisions.

With our Global Oil Storage Rate Report, you’ll gain access to the single and only authoritative source of storage rate information available worldwide. It will provide you with transparency on price levels in global tank storage markets regularly, so you are always in the know and can set the right ask and bid prices for your storage.

Download your FREE Sample Report now and discover what information you could have at your fingertips each quarter.