Tank Storage Demand Drivers – Market Structure

The market structure stimulates traders to buy now and sell late. In this article we would like to highlight the themes contango and backwardation and what market structure means for tank storage operators.

Market structure – Introduction to contango and backwardation

An oil price for immediate delivery is called spot price or cash price while an oil price for delivery at a specified date in the future is called a forward price. When we plot these various prices and order them from short to long term delivery, a forward curve is created.

Learn what drives tank storage demand. Join the FREE Webinar: Insights Global Tank Terminal Commercial Performance Model upcoming March 18th 2020.

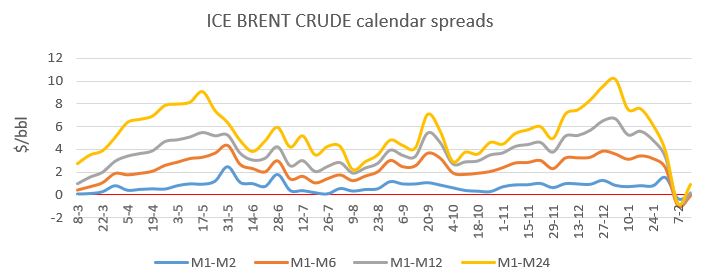

When a futures price (second month) is below a futures spot price (first or front month), the market structure is in backwardation. In this case, the forward curve is downward sloping. When the futures spot price is below the futures price, the market structure is known as contango. In this case, the forward curve is upward sloping.

Figure 1: Forward curve ICE Brent crude futures

A contango usually occurs when supply is higher relative to demand (supply glut) while in a backwardation demand is higher relative to supply (shortage). As time evolves, an oil forward curve can switch from backwardation into contango as in the case of the NYMEX RBOB futures forward curve. When a cyclical pattern is visible, this is called seasonality.

With respect to NYMEX RBOB futures, US gasoline prices tend to rise towards summer driving season during the period June and September. In the period before peak demand, oil traders tend to buy and store products to have product available in times of high consumption.

Learn what drives tank storage demand. Join the FREE Webinar: Insights Global Tank Terminal Commercial Performance Model upcoming March 18th 2020.

Importance of market structure for tank storage companies

In a period of contango, oil traders are encouraged to buy oil products today and sell in the future when the spread between two months covers storage, shipping and finance costs. When this opportunity presents itself, product is being sold, shipped and stored, resulting in more business for tank storage companies. This play is known as a ‘contango storage play’ but is limited by the maximum tank storage capacity available.

In some rare occasions, when the time spread is large enough even tanker vessels are chartered by trading companies to store oil products. This is known as floating storage. In this rare environment demand for tank storage is high and pushes storage rates for spot availability. Backwardation discourages storing oil products as a trader can sell oil today at a better price than in the future.

Is market structure the only business opportunity indicator for tank storage companies?

There are other indicators that should be taken into account such as price volatility, arbitrage and more. These topics and Insights Global’s market model will be covered in upcoming weeks.

Learn what drives tank storage demand. Join the FREE Webinar: Insights Global Tank Terminal Commercial Performance Model upcoming March 18th 2020.