Europe Battles to Secure Specialised Ships to Boost LNG Imports

Europe’s plan to reduce dependence on Russian gas and strengthen the continent’s energy security depends on its ability to secure specialized ships that provide the fastest way to import alternative supplies and quickly build the associated infrastructure.

Since Russia invaded Ukraine last month, Germany, Italy and the Netherlands have announced plans to secure floating storage and regasification units (FSRUs) – liquefied natural gas tankers with heat exchangers that use seawater to convert the supercooled fuel back to gas.

These docked ships offer Europe the fastest way to end its dependence on pipelines carrying large amounts of fuel from Russia. “Europe is crying out for FSRUs to get energy in whatever it takes,” said Yngvil Asheim, director of Oslo-based BW LNG, one of the world’s handful of FSRU owners.

The EU plans to cut its dependency on Russian natural gas by two-thirds by the end of this year and aims to import 50 billion cubic meters of LNG annually. While there are doubts about whether there is enough LNG supply worldwide to meet European needs, analysts say infrastructure could be a critical bottleneck.

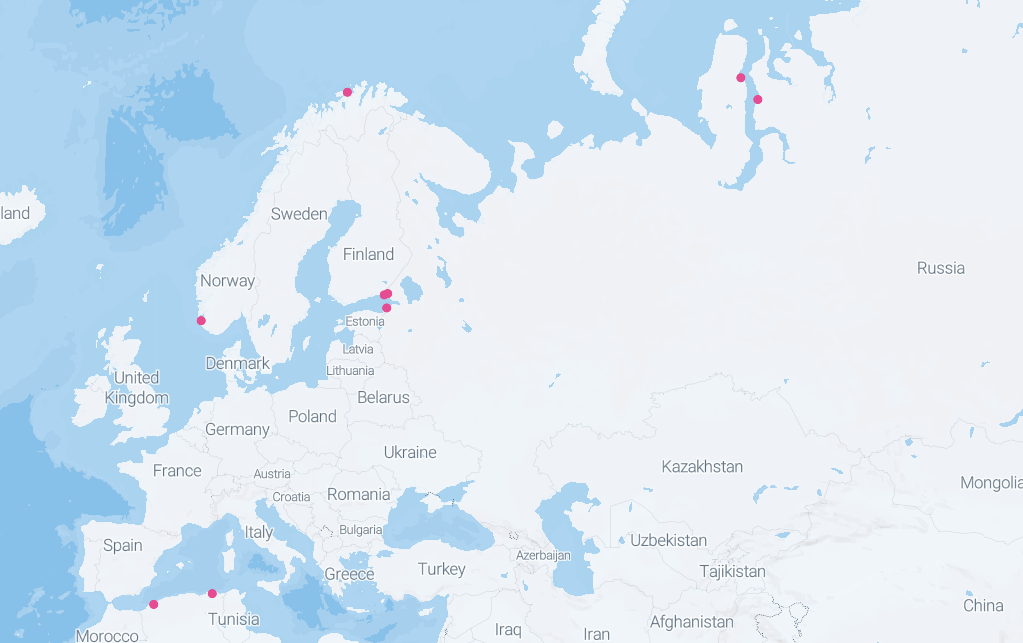

Europe has the infrastructure to regasify 170 bcm of LNG, but most of the spare capacity is in the Iberian Peninsula, which lacks sufficient pipelines to move supplies further north.

The construction of LNG import terminals on land takes at least five years and is expensive. FSRUs, which can each import about 5 bcm per year, are cheaper and faster to install. But despite being faster to install, FSRUs can still take several years to install. Global supply chain tightness threatens further delays, industry figures say.

Germany, which has no LNG import terminals, is exploring possible locations in the North and Baltic Seas for three FSRUs with an estimated capacity of 27 bcm, and estimates the first could come into operation this year. Jason Feer, head of business intelligence at energy and shipping brokerage Poten & Partners, predicts that Germany’s first FSRU will not be operational before 2024.

The Dutch gas transport group Gasunie has said it may be able to import LNG in the third quarter of this year. Robert Songer, an analyst at ICIS, a commodity data company, said this project was first planned a decade ago. “Anything bigger and not yet on the drawing board will definitely take longer,” he said.

Reserve ships are also scarce. Of a global fleet of about 50 FSRUs, Karl Fredrik Staubo, chief executive of Golar LNG, a Bermuda-based FSRU owner, estimates that only five vessels are available and three of contracts could be released this year. Not all of these are suitable for Northern Europe as water below 10C is too cold for the heat exchange system used on some ships.

Europe could accelerate the green shift, but what will happen in the rest of the world and Asia. At these prices they will burn coal.

According to industry sources, charter rates for FSRUs have risen by at least 50 percent since the outbreak of war in Ukraine to between $150,000 and $180,000 per day. Rystad Energy estimates it costs $40mn to $60mn per year to charter an FSRU. “Companies are in a bidding war” [for FRSUs]”, says Gordon Milne, director of FSRU Solutions, a consultancy.

Until the sudden surge in demand, the FRSU market suffered from overcapacity. “It no longer makes sense to build a new FSRU,” says Oystein Kalleklev, Flex LNG, an LNG shipping company. Due to construction backlogs, it may take until 2027 before a new unit is delivered.

The increased competition for LNG and the FSRUs needed for its imports is likely to deter poorer future LNG importers, such as Sri Lanka, Brazil and Panama, who would instead turn to dirtier fuels. “Europe could accelerate the green shift, but what will happen in the rest of the world and Asia,” Asheim said. “At these prices they will burn coal.”

WHATSNEWS2DAY, by Jacky, April 14, 2022